Created for investors to access the diversification benefits of a formerly exclusive, often expensive, but compelling asset class. This Index-Plus, low cost and diversified solution delivers efficient exposure to the managed futures space.

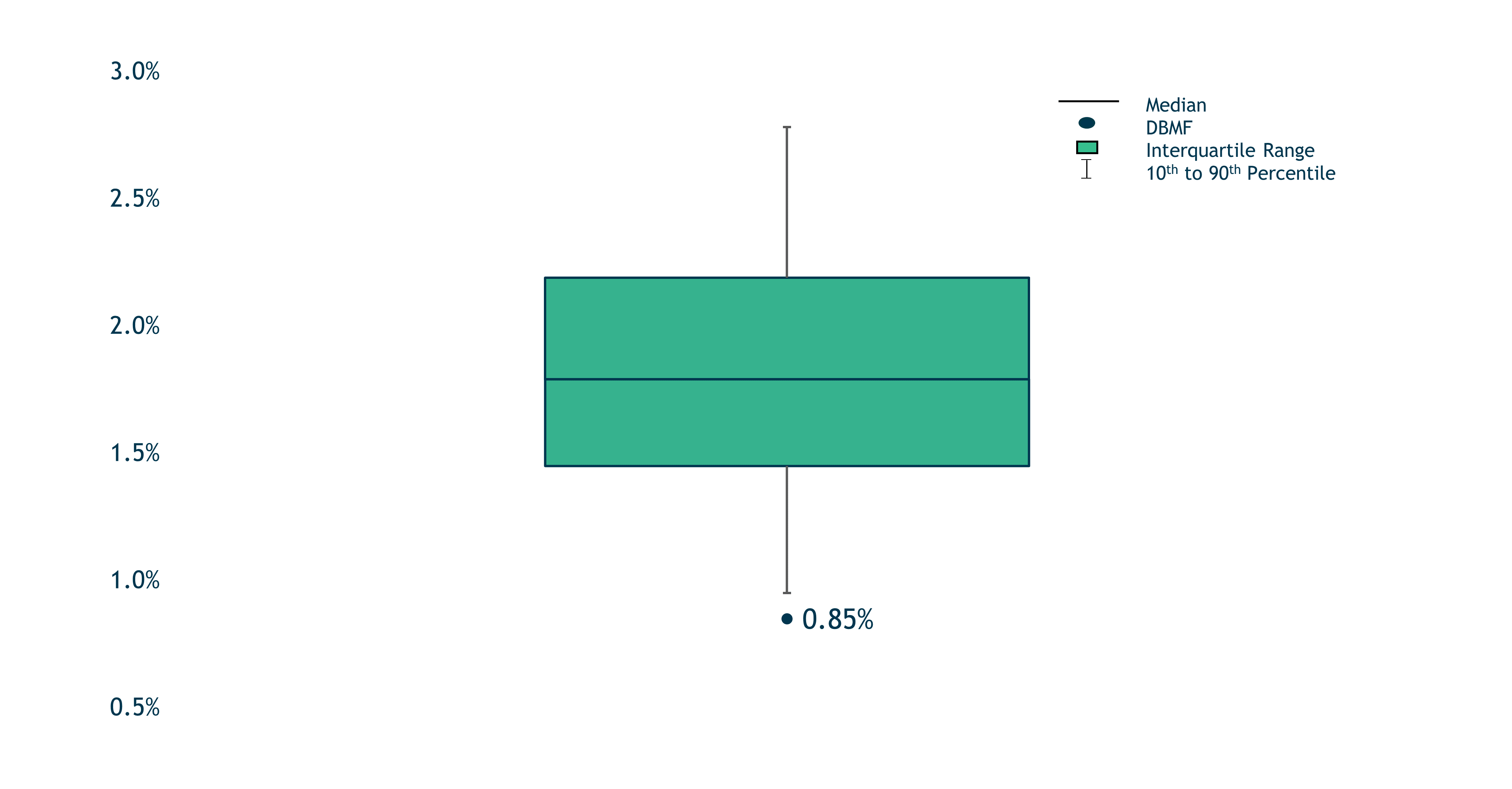

DBMF expense ratio is at the bottom decile of peers

Confidence tracking to index

DBMF has delivered returns over category for 5 years

The iMGP DBi Managed Futures fund seeks to replicate the pre-fee performance of a representative basket of leading managed futures hedge funds.

Through this strategy, the fund aims to mitigate three key investment risks:

Illiquidity, trade crowding, counterparty

Single Manager, Single fund, industry, geography

Selection bias, etc.

The iMGP DBi Managed Futures fund seeks to replicate the pre-fee performance of a representative basket of leading managed futures hedge funds.

| Top 5 holdings (as of December 31, 2023) | |

|---|---|

| S&P 500 | 28.3% |

| SOFR | -20.3% |

| 2 Yr Treasury | -20.4% |

| Emerging Markets | -21.0% |

| JPY/USD | -21.5% |

| Asset class exposure (as of December 31, 2023) | |

|---|---|

| US Equities | 28.3% |

| International Developed Equities | 2.6% |

| Commodities | -0.9% |

| Currencies | -13.0% |

| Emerging Market Equities | -21.0% |

| Fixed Income | -58.9% |

The iMGP DBi Managed Futures fund seeks to replicate the pre-fee performance of a representative basket of leading managed futures hedge funds.

DBMF seeks to optimize net returns to investors by approximating the main exposures that drive performance, minimizing trading and implementation costs, and offering lower all-in fees.

| Continent | Net of fee returns | |

|---|---|---|

| Pre-fee return | ||

| Net return to investors | Management fees, incentive fees & trading costs |

| Continent | Net of fee returns | |

|---|---|---|

| Pre-fee return | ||

| Net return to investors | Management fees & trading costs |

DBi's Strategies seek to outperform by delivering 80-100+% of pre-fee hedge fund returns with lower fees and expenses.

Download essential reports and updates to stay informed.

Founded in 2012 in New York (NY, USA) and with a track record since 2007, the firm manages liquid alternative strategies through liquid futures and ETFs.

See the latest materials from DBMF including factsheets, presentations, commentaries and more.

We are a worldwide asset management network providing access to high-quality investment firms.

Performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the fund may be lower or higher than the performance quoted. Performance data current to the most recent month end may be obtained by calling 888-898-1041.

Short term performance, in particular, is not a good indication of the fund’s future performance, and an investment should not be made based solely on returns.

All of the assets and liabilities of the Predecessor Fund were transferred to the Fund in a reorganization on 09/20/2021.

Shares of any ETF are bought and sold at market price (not NAV), may trade at a discount or premium to NAV and are not individually redeemed from the Fund. Brokerage commissions will reduce returns.

SG CTA Index:

The SG CTA Index is an index published by Société Générale that is designed to reflect the performance of a pool of Commodity Trading Advisor (CTAs) selected from larger managers that employ systematic managed futures strategies. The index is reconstituted annually.

An investment strategy that seeks trends across commodity, rates, currency, and equity markets.

Dynamic and tactical approach, not static

Takes long and short positions using futures contracts

Humans build models, models determine portfolios

Durable source of alpha based on prices, not macro calls

An incredibly valuable portfolio diversifier to stocks and bonds

Explore how to build a durable strategy using managed futures.

DownloadExplore key considerations when allocating to managed futures.

Get InsightsWatch the webinar on managed futures and the DBMF strategy.

WatchRead about the replication strategy and its market relevance.

ReadDownload essential reports and updates to stay informed.

Interviews, commentary, and thought leadership from our experts.

Get answers to your questions from our portfolio managers